Understanding Your Personal Guarantee Exposure

Are you a UK business owner or director grappling with the daunting weight of a personal guarantee (PG)?

The feeling of overwhelming pressure, of your personal assets being vulnerable due to your company’s financial challenges, is a reality many face.

At Bell & Company, as the UK’s leading business and personal debt strategists, we understand this profound stress.

You’ve likely poured everything into your business, and now, the lines between business and personal liability feel blurred. You are not alone, and crucially, you are not without powerful options.

If you’re a gym owner or fitness professional dealing with creditor pressure, asset finance liabilities, or personal guarantees following a business closure – you are not alone.

We specialise in helping directors like you negotiate manageable outcomes, reduce personal exposure, and regain control after financial distress.

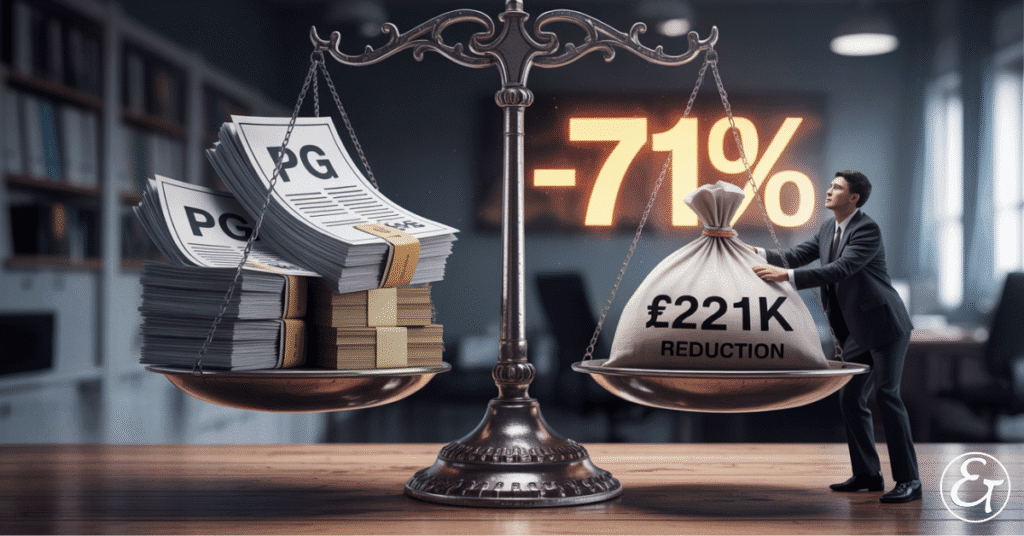

Client Case Study: Personal Guarantee Success

One of our clients faced a spiralling PG liability, escalating from £118,563 to a staggering £311,827.

This was a direct consequence of pandemic fallout, business repossessions, and aggressive creditor action. They were at breaking point, with three properties already lost and their family home next in line. Every phone call brought dread until they engaged with our expert debt solutions team.

Our Strategic Approach:

- Advanced Creditor Action Interception: We immediately implemented strategies to halt impending creditor actions, preventing further asset forfeiture.

- Comprehensive Financial Data Structuring: Years of complex financial paperwork and correspondence were meticulously organised and analysed, creating a clear, digestible data set.

- Holistic Case Development: Our team built a robust case, presenting the full financial and operational context of the business, not just the raw debt figures.

- Informed Creditor Negotiations: We leveraged data-driven insights to negotiate with creditors in a highly competitive market, predicting potential outcomes and optimising our negotiation stance.

The Optimised Outcome:

The result was a remarkable £90,200 full and final settlement, leading to a £221,627 saving.

This was achieved without court proceedings, avoiding bankruptcy, and most importantly, securing the protection of their family home.

This case exemplifies the tangible benefits of expert personal guarantee negotiations.

The Truth About Personal Guarantees: Negotiable and Defendable

Many perceive personal guarantees as an inescapable trap. However, as the UK’s foremost authorities on business and personal debt, we assert a different reality:

- They are highly negotiable.

- They are fundamentally defendable.

- With the right commercial-powered strategy and expertise, they absolutely do not have to lead to financial ruin.

Far too many directors endure silently, burdened by shame, overwhelmed by the perceived inevitability of full repayment. This simply isn’t the case. Our team are here to offer you a clear pathway to resolution.

Don’t Let Fear Drive Decisions

If you’ve received a Statutory Demand linked to a personal guarantee, or find yourself avoiding calls and letters, we urge you to act decisively now.

At Bell & Company, we have empowered hundreds of UK directors and business owners in precisely your situation. We intimately understand the stress and the emotional toll. More importantly, we possess the specialist knowledge and strategic frameworks to resolve it.

The moment we deliver the news -“It’s done; they’ve agreed to settle” – is unparalleled. We are committed to achieving that moment for you.

Take proactive control of your financial future. The sooner you engage, the greater your options for a favourable outcome.

📞 Speak to our team today for a confidential case review and tailored guidance.

[Book a Free Case Review] | [Explore Our Debt Advice Hub] | [Read Our Trustpilot Reviews]