Business Debt Help That Puts You First

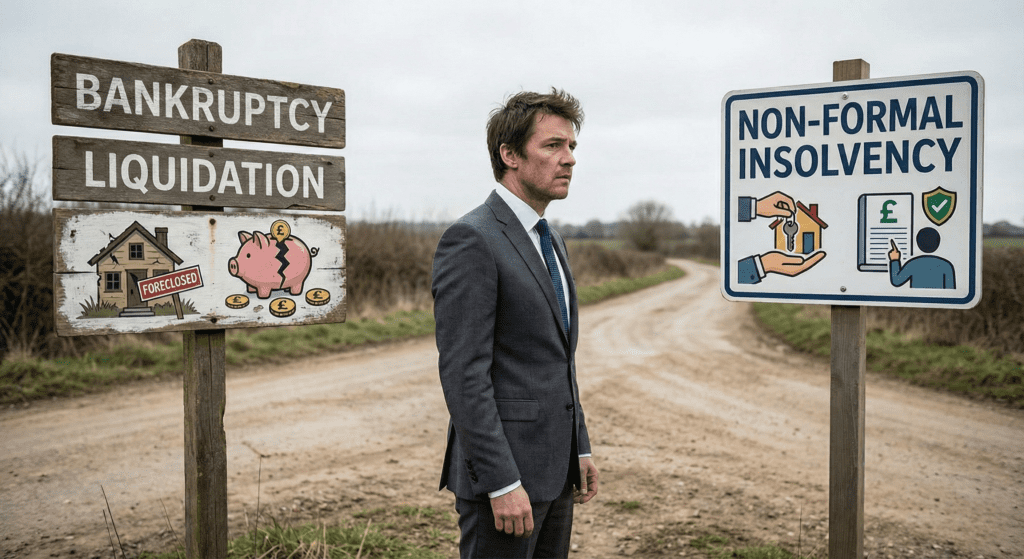

At Bell & Company, we specialise in personal and business debt help that protects you, your assets, and your future. Unlike traditional insolvency firms, we work exclusively for our clients, never for creditors.

As Debt Strategists, we don’t follow a one-size-fits-all insolvency route. Instead, we create tailored solutions that give you control and deliver the best possible commercial outcome.