It often starts innocently enough. A late payment from a reliable client. A “one-off” disruption you didn’t plan for. To bridge the gap, you dip into personal funds or take a short-term loan. You’re not being reckless, you’re doing what most directors do to keep things moving, fully expecting the numbers to catch up.

But for many UK directors, the catch-up never comes. Instead, interest accrues, HMRC notices turn from blue to red, and suddenly, the business problem you thought you could outrun has become a personal crisis that’s keeping you awake at 3:00 AM.

If this feels familiar, you aren’t failing. You’re just out of options – or so you’ve been told.

The Myth of the “Point of No Return”

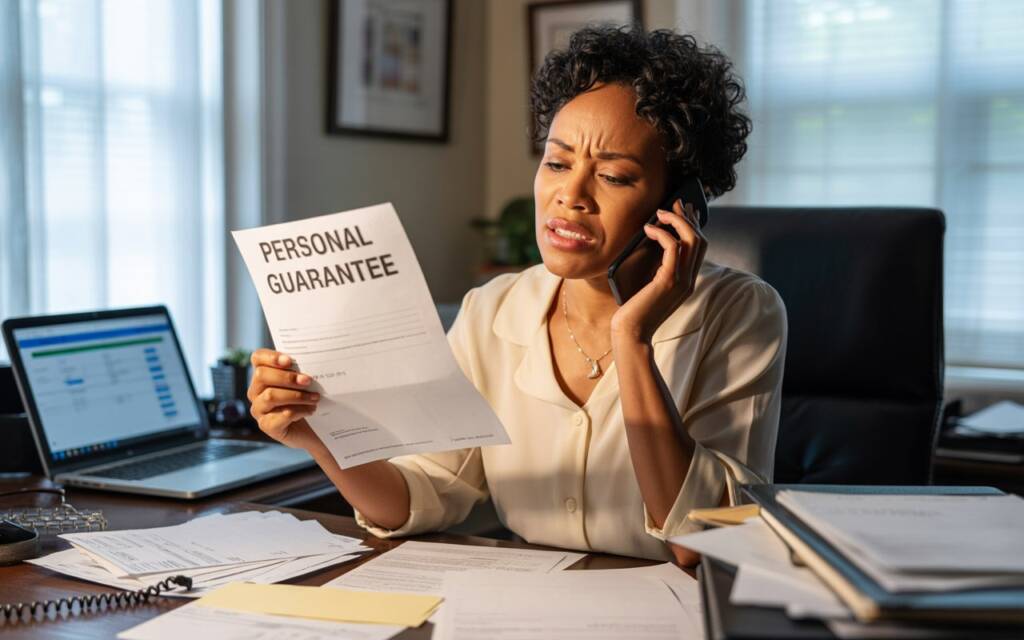

Most directors reach out to us when the pressure becomes physical: when sleep loss turns into health issues, or when a Personal Guarantee (PG) suddenly feels like a noose.

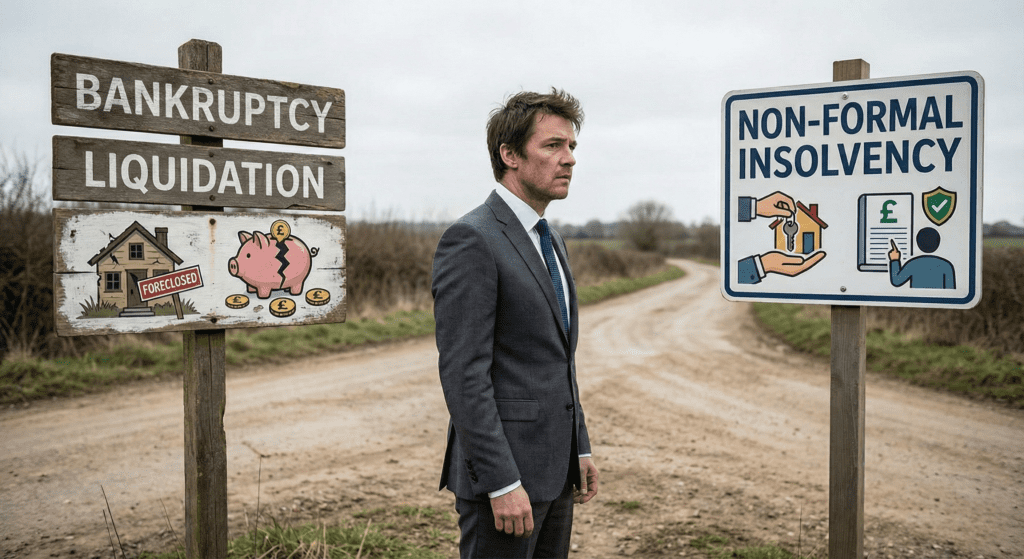

The biggest misconception in the industry is that once creditors escalate, the game is over. You’re pushed toward bankruptcy or IVAs as if they are the only exits left.

They aren’t.

Behind the scenes of these “hopeless” situations, there is a different reality, one where strategic negotiation and professional representation can change the maths entirely.

The Power of Strategy Over Fear

What happens when you stop reacting to threats and start managing liabilities strategically? The numbers change.

We’ve seen it time and again. It’s not about “miracles”, it’s about knowing the leverage points that can be used to support your situation. But don’t just take our word for it, here’s what our clients have to say:

- The “Impossible” Settlement: “Being such a large sum I was surprised at how quickly Rory negotiated an agreement, from a figure that the insolvency company had of £250K to the settlement figure of £35k.” – Claire, August 2024

- The 93% Reduction: “I don’t mind admitting going into a panic… from my first phone call to my last, a huge weight was lifted from my shoulders and I no longer felt alone…When Rory told me what he had negotiated, I was overcome with relief and joy at what had looked like a dire financial situation prior. Rory and the team negotiated a 93% reduction.” – David, February 2025

- The Total Cancellation: “To my utter amazement and joy, the liability & PG was completely cancelled, and the amount demanded was reduced to zero!!” (He had originally only hoped for a reduction) – Merfyn, December 2025

- The Complete Relief: “Bringing this team on board was one of the best decisions I made… the monkey is off my shoulder and I’m living life a little lighter.” — Thomas, December 2024

Why “Waiting and Seeing” is the Most Expensive Strategy

The common denominator in every success story we have is the moment the director stopped “burying their head in the sand.”

The “despair and panic” directors often feel – sometimes for years – doesn’t disappear because the debt vanishes on its own. It disappears because they choose to walk away from the hope-based strategy and toward an evidence-based resolution.

We help directors:

- Map the Terrain: Understand exactly where you stand (legally and financially).

- Buffer the Blow: We take over the calls and negotiations so you can breathe.

- Protect the Future: Explore restructuring that saves your livelihood and assets.

- Restore Control: Transition from being a victim of circumstances to the architect of your exit.

Your First Step (Without the Pressure)

You don’t have to commit to a path today. You just need to know what the paths are.

We offer a Free Initial Case Review. No obligation, no judgment. Just a confidential space to lay out the facts and see the options you didn’t know you had.

Stop fighting a losing battle alone. Let’s look at your entire situation together.

Book Your Free Consultation Now

Visit Our Director’s Debt Advice Hub

P.S. Even if you aren’t ready to talk, don’t stay in the dark. Our Advice Hub is packed with free guides and videos designed to help you understand your rights and risks. Knowledge is the first step back to sleep.