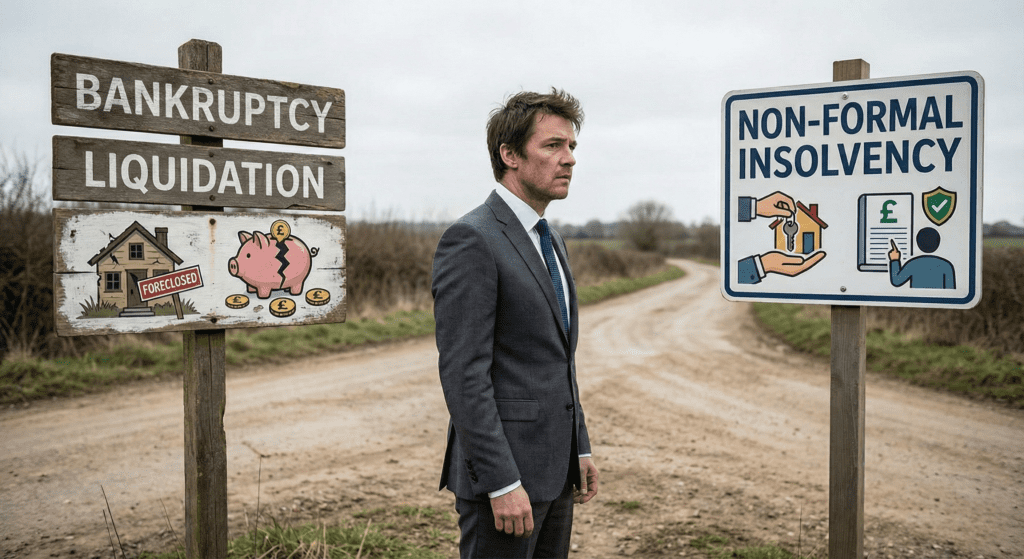

In the current financial landscape of the UK, business owners often encounter challenging scenarios, particularly when dealing with debts. An increasing number of businesses are facing significant financial challenges, primarily due to accumulating arrears with HMRC and energy providers. These debts can trigger insolvency, as companies struggle to balance their liabilities with diminishing assets and cash flow. Businesses are forced to overcome tightened credit markets, disrupted supply chains, employment instability, and sector-specific challenges. Making it crucial to understand the steps creditors will take if you fall into arrears.

When you fall into arrears with a creditor, they have two instruments that they will utilise to recover the debts, which are Statutory Demands and Winding Up Petitions. Understanding their differences, processes, and implications is vital for informed decision-making and safeguarding your business interests.

What is a Statutory Demand?

A Statutory Demand serves as a formal request from a creditor for debt repayment. It’s typically the initial legal step when a debt remains unpaid. The debtor is given 21 days to settle the debt, complete an application to set aside the demand or negotiate a payment plan. Failure to respond appropriately can escalate the situation, potentially leading to a Winding Up Petition.

What is a Winding Up Petition?

A Winding Up Petition is a more severe recovery action initiated by a creditor to force a company into liquidation. This measure is usually considered after previous debt recovery attempts, such as a Statutory Demand, have been unsuccessful. This will be submitted to the court, and if successful, a Winding Up Order will result in the appointment of a liquidator and the eventual dissolution of the company.

Key Differences

Purpose:

- Statutory Demand: This is a formal notice requesting the repayment of a debt. Its scope is limited to debt recovery. It is not a court process in itself but a precursor to potential legal action. The primary goal is to prompt the debtor to address the outstanding debt, offering a window of opportunity for the debtor to either settle or dispute the claimed amount.

- Winding Up Petition: In contrast, a Winding Up Petition is not merely a demand for debt repayment; it is a legal action initiated to close down a company permanently. The scope here is much broader and more severe – it involves the entire liquidation process of the company. This petition is filed in court when creditors believe that the company is insolvent and unable to pay its debts. The purpose is not just to recover debts but to dismantle the company’s structure, sell its assets, and distribute the proceeds to the creditors.

Process:

- Statutory Demand: When a company receives a Statutory Demand, it has a defined period (usually 21 days) to either pay the debt, negotiate a settlement with the creditor, or challenge the demand if there’s a dispute over the debt’s validity. The process here has a smaller chain of communication and allows for direct negotiation between the debtor and the creditor. It’s critical for the company to take action to prevent escalation to more severe legal proceedings. If the company believes the demand is unsubstantiated, it can apply to have the demand set aside.

- Winding Up Petition: The response to a Winding Up Petition is more complex. Once a petition is filed, it typically results in a court hearing where the company’s solvency and ability to repay its debts are scrutinised. The company must provide a defence if it intends to contest the petition. This often involves presenting evidence of solvency, proposing a viable repayment plan, or disputing the creditor’s claim. Likewise to responding to a Statutory Demand, dealing with a Winding Up Petition requires professional assistance. The company must act quickly to seek an adjournment for more time to resolve the issue or prepare for a battle to dispute the petition. Failure to adequately respond to a Winding Up Petition can lead to the court issuing a Winding Up Order, marking the beginning of the liquidation process.

Responding to Recovery Actions

When faced with a Statutory Demand or a Winding Up Petition, seeking the help of experts in the field is crucial. If disputing a Statutory Demand, Bell & Company can aid in applying to have it set aside, navigating the complex process. Similarly, upon receiving a Winding Up Petition, immediate consultation with insolvency experts is essential. We can assist in negotiating settlements and payment plans with creditors or finding alternative solutions. In both cases, the expertise of Bell & Company is invaluable in guiding through the difficulties and strategising for the best possible outcome, whether it’s resolving disputes over debts or preventing the company from being wound up.

FAQs

- Can a company recover after a Statutory Demand or Winding Up Petition?

- Recovery is possible after a Statutory Demand if the debt is settled or an alternative agreement is agreed upon. However, recovery after a Winding Up Petition is much more challenging and often signifies the end of business operations.

- What are the long-term effects of these actions on my business?

- Your business’s credit rating can be damaged, making it challenging to secure future financing or credit facilities. Secondly, your business’s reputation amongst suppliers, clients, and within the industry may suffer. Lastly, directors might face personal financial consequences, especially if personal guarantees are in place. This not only affects personal credit ratings but also can lead to personal assets being at risk.

- How can I prevent these situations?

- Maintain accurate financial records, understand your liabilities, seek early professional advice when facing financial difficulties, and communicate proactively with creditors.

- Can a Winding Up Petition be served without a Statutory Demand being issued prior?

- Yes, a Winding Up Petition can be served without a prior Statutory Demand. While a Statutory Demand is often used as a preliminary step before escalating to a Winding Up Petition, it’s not a legal prerequisite. Creditors may choose to directly file a Winding Up Petition if they have sufficient evidence to demonstrate to the court that the company is insolvent and unable to pay its debts.

Addressing both Statutory Demands and Winding Up Petitions requires a delicate balance of expert insight, financial acumen, and prompt action. This is why UK business owners turn to Bell & Company as their expert debt advisors. Give us a call at 0333 305 4331 to speak with a member of our specialist team.