When a business is struggling, directors often jump to the conclusion that administration is the only way to save their business. This will see the appointment of an Insolvency Practitioner (IP) to oversee this ‘rescue’ option that often ends in liquidation.

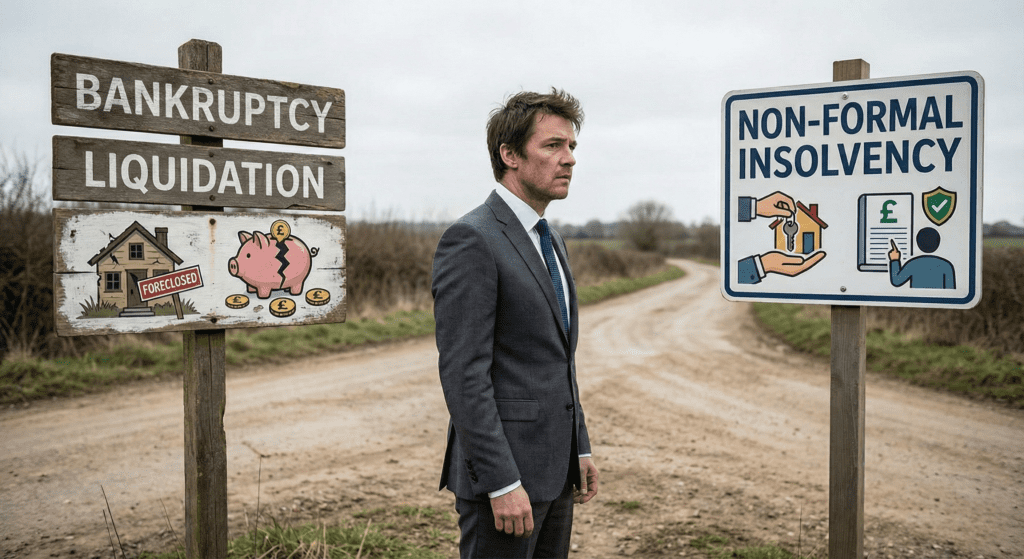

Whilst there are some situations in which formal insolvency is the best option available, in almost all cases, there are better alternatives. These alternatives provide options but avoid a lot of the negative impacts associated with administration. So, is administration right for your business?

How Administration Is Supposed To Work

A business can enter administration voluntarily or, can be forced into it by a creditor. Either way, a licensed insolvency practitioner is appointed to oversee the day-to-day running of the business. This process needs the permission of company creditors.

Once administration begins, a moratorium is issued that prevents further action by creditors for a period of time. The idea behind this is that the business has time to either recover or formulate a suitable strategy to deal with issues in the long term. Once this has been agreed, the company can exit administration.

The Reality

The above is how the administration process is supposed to happen however, this is rarely the case. In fact, over 90% of administrations actually end in liquidation. Less than 10% are completed successfully (i.e. the company continues trading).

Often when companies enter administration, they are already in terminal decline and have little to no prospect of recovery. In cases like this, it is best to recognise that there are more commercial options. Additionally, as part of the process, your company must add the phrase “In Administration” to all documents, invoices etc. This is a red flag to any creditors or suppliers and will make any previous business relationships almost impossible to maintain.

As well as this, the appointed administrator is unlikely to have specific knowledge of the sector in which the business operates. This further reduces the likelihood of success.

Administration is by far the most expensive form of insolvency. The initial payments will be high and, because of the hands-on nature, the ongoing costs will be astronomical. This is because the IP in charge will charge the company for every piece of work completed, every letter sent and every phone call made. These charges are a further hindrance to recovery for your business.

What Administration Means For Directors

Since it is sold as a ‘business recovery’ measure, directors rarely think about the personal impact. Administration is still a type of formal insolvency, as a result, directors can face personal liability.

Any personally guaranteed loans can be ‘called in’ by lenders after a company enters insolvency. So, even though the company is still trading, you could face repercussions.

If your business has to be placed into liquidation, you will face the possibility of an investigation into your conduct, HMRC liabilities and more. So not only is it costly for your business, but could end up costing you and your co-directors personally.

Make The Right Choice

Although administration may not be the shiny new solution that it is advertised as there is good news. The are plenty of alternatives available, and almost all of them limit your personal exposure whilst providing your business with the best chance to get back on its feet.

Before taking any action, you have to be able to make an informed decision. The only way to do this is to fully understand your situation and all of the potential outcomes. If you need advice on administration, feel free to contact us on 0333 305 4331, request a callback or join our live chat below to speak to an expert.

All of our initial conversations are confidential and obligation-free so you know you are getting the best, impartial advice.