The Recovery Loan Scheme (RLS) was introduced as the successor to the CBILS and BBLS schemes. The idea was to help businesses continue to recover from the Covid-19 pandemic through accessible finance.

A total of £1.06 billion was given to UK businesses with £10m initially being the maximum available to borrow, this was later dropped to £2 million.

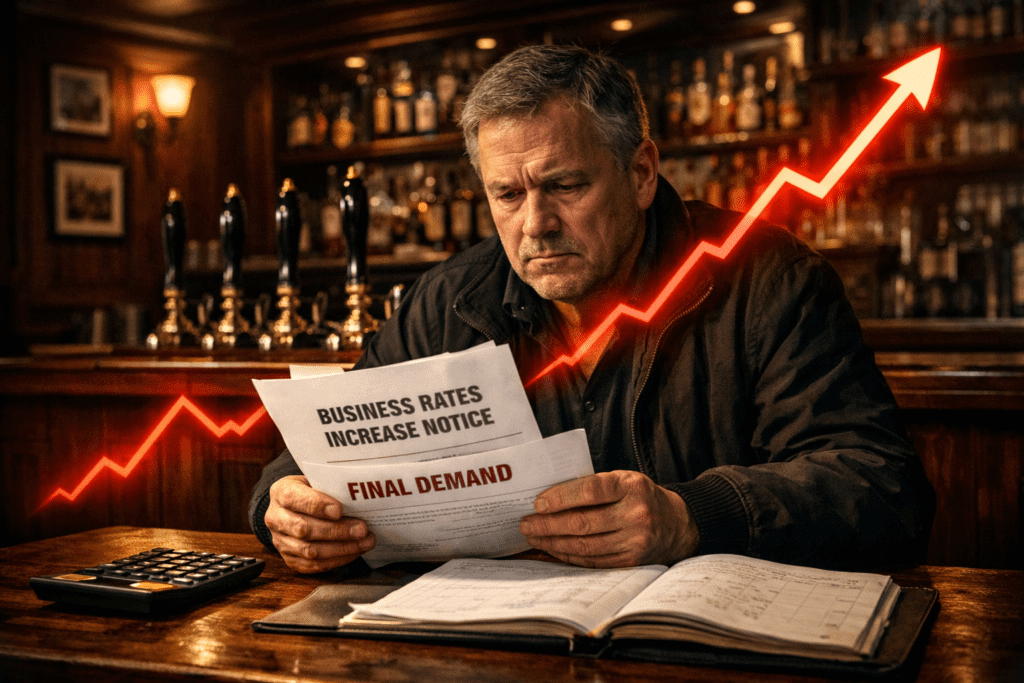

Now, as many businesses continue to struggle, these ‘recovery loans’ have become a serious burden.

What are the rules?

The requirements were broadly similar to the CBILS and BBLS schemes in terms of eligibility. Certain criteria had to be met in terms of profit, turnover, and the size of the business.

There was no repayment, interest, or fee-free period, unlike CBILS and BBLS. This means that businesses had to start repaying from the outset.

Similar rules were also put in place in terms of how the loan could be spent i.e., only for business use.

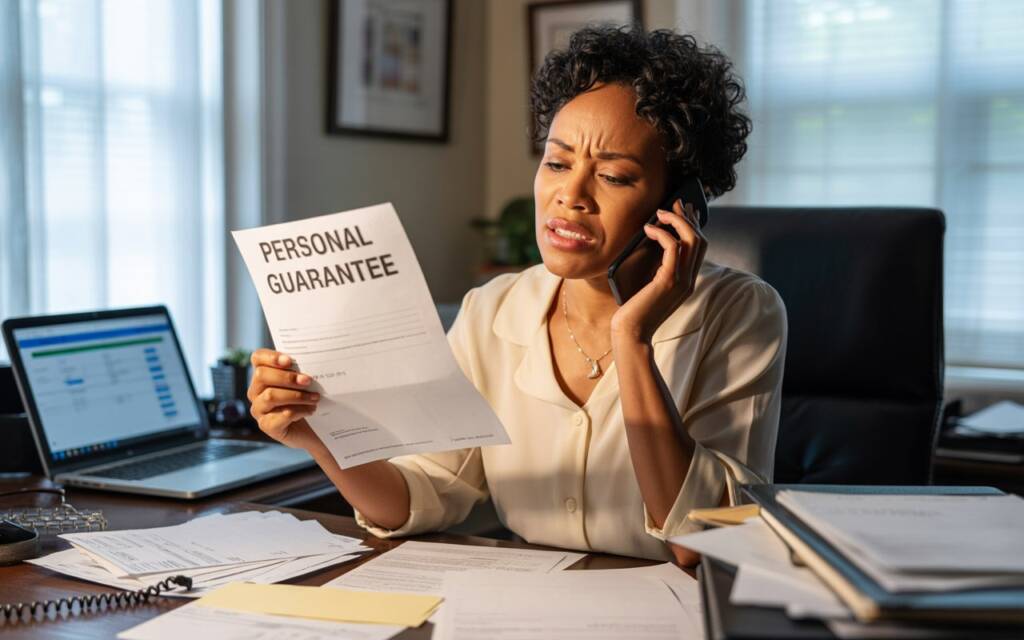

Recovery Loan Scheme: Personal Guarantee?

For any loans under £250,000, you will not have been asked to provide a personal guarantee to access the recovery loan scheme.

Any amount over £250,000 will have required you to personally guarantee the loan. This means, if your business struggles, misses payments or enters into insolvency, you will be liable for the full remaining value of the loan.

The Personal Guarantee repayment value is capped at 20% but this could still leave Directors with significant personal liability.

Government-backed, what does it mean?

Like other Covid-19 loan schemes, the UK government promised to cover 80% of the amount borrowed if a business is not able to fully repay its loan.

Many took this to mean that they would be paying 80% of what they owed. This is not the case as the lender must ‘exhaust all recovery options’ before they can receive this 80% from the Government.

In essence, this means the loan will be treated like any other loan, your business remains 100% liable for the debt and you will not be given a “by-ball” if you fail to pay. Action will include compulsory liquidation of your business and personal insolvency for those who signed Personal Guarantees.

Can’t Repay Your Recovery Loan Scheme Loan?

Your options here all come down to whether you provided a Personal Guarantee for your business’ loan.

If this is the case, you will be liable for up to 20% of the total liability. So, for example, if you borrowed £500,000 you will be pursued for £100,000.

One limitation is that your ‘Principal Private Residence’ cannot be used as security. Meaning, that the loan cannot be secured against your home. However, if you cannot repay your personal liability, your lender will likely seek to make you Bankrupt. In this case, your home, assets, and income are all at risk.

An RLS loan in Insolvency

It is likely that when you took this loan, you did so thinking that your business would recover and pay back what was owed. But the continuing economic turmoil is pushing more businesses into insolvency. So, what happens to your loan if your business enters insolvency?

If you are attempting to dissolve your company, it is likely this will not be possible. Any Creditors will be notified of attempts to dissolve a company and will block it by objecting to the dissolution. The only case where it may be possible is if there is no way the company could feasibly repay the loan and there are no assets in the business.

In Liquidation, your company’s assets will be sold to pay your Creditors. If your loan was not personally guaranteed, you will likely not be liable for any of it, and it will not appear on your personal credit file.

However, by liquidating or dissolving a company, you open yourself up to scrutiny and investigation if you attempt to dissolve a company. The Insolvency Service has been granted powers to investigate companies and directors, you can find out more about this here.

If Directors are found to have acted irresponsibly, they can be made liable for part of, or all, company debts. ‘Irresponsible’ could mean spending the loan on something you shouldn’t have, continuing to trade whilst insolvent or mismanaging company finances.

What to do if you can’t repay your RLS Loan

As with any debt issues, a wrong step could land you in serious trouble. That is why getting the right advice should always be your first step before you make any major decisions. Bell & Company provide independent, expert financial advice.

We can explore your options and provide a tailored solution based on your current situation, if you would like to speak to a business specialist, contact us today. You can call us on 0333 305 4331 or use the live chat at the bottom of this page to speak to a member of the team.