Many UK businesses are falling victim to large sums of rent arrears that have built up. Those most at risk are business owners who have personally signed a guarantee on a lease.

Business owners already struggling with rent arrears are now contending with reduced capacity and are left playing financial catch-up.

The ‘C word’ – CVA

Multiple recent examples have seen large businesses entering into a Company Voluntary Arrangement (CVA). This involved moving their business fully online to avoid paying landlords large sums of money. SMEs often do not have the option of a CVA as it is a form of insolvency. Any form of insolvency could result in the triggering of a personal guarantee. (For clarity, most SME companies are required to give a Personal Guarantee to support any lease.)

The economic effects of the pandemic are only beginning to be felt and leases will no doubt become a major issue for UK businesses.

Commercial Leases – What are my options?

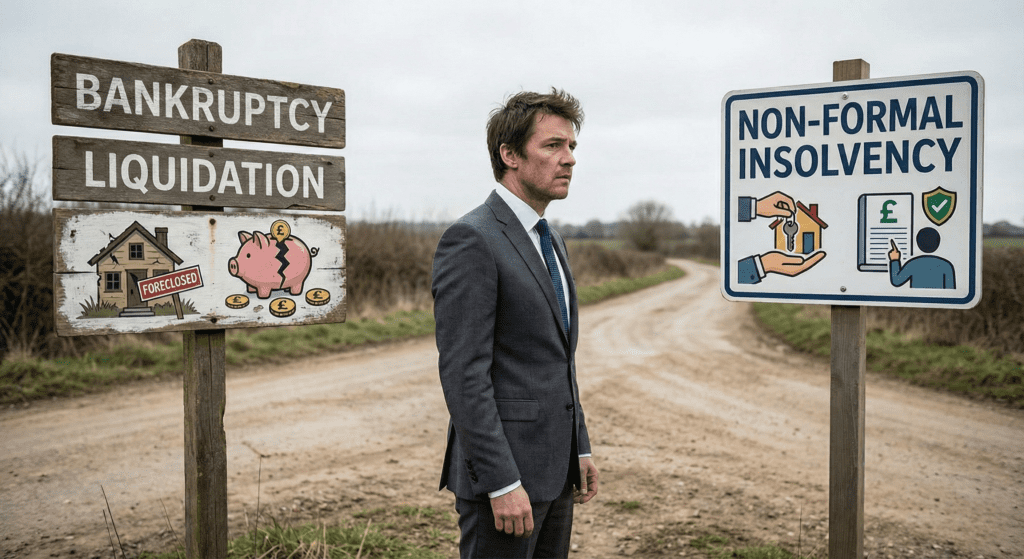

If your business is struggling with a rental or asset-type lease, there are a few avenues that will allow you to avoid potential legal action.

- Negotiate with the landlord: Being upfront and honest can work although, there is a chance your landlord won’t end your lease early. (Especially if it would be difficult to find another tenant or they are likely to incur financial losses.) A commercial full and final settlement can be an option to settle the liability on your commercial lease.

- Alternative finance: Depending on your financial situation and the type of business, alternative finance could provide a flexible lump sum. This does result in another creditor to pay and can come with high interest rates.

- Restructure your debt: If you have more than one creditor you could enter a CVA. Whilst this can help manage debt, if you fail to make payments you will be liable for the full amount, this could result in legal action. A CVA is also not advisable if you hold a personal guarantee on your lease.

- Administration: This is a costly process and involves an independent insolvency practitioner taking control of the company to assess its viability. Your company must be insolvent or contingently insolvent, but cash flow is key to administration. Without cash flow, the administration process will fail. Some businesses avail of this option as it freezes creditor litigation proceedings. Your business is required to put “In administration” after its name on all correspondence. This could result in reluctance from trade creditors to do business or extend credit.

- Liquidation: This is the closure of the company, and all liabilities will be ‘written off’. This is an attractive process for a company with few assets, many creditors and no Personal Guarantees.

- Bankruptcy: This is an option if there is a personal guarantee on the lease. This option should not be entered hastily as you should be fully aware of the ramifications on your assets, income, previous transactions and your conduct.

Whilst there are ways to relieve the financial stress of lease issues, most are formal options. After over a decade in the world of debt, we always recommend an informal approach. This is because it allows for flexibility and benefits both debtors and creditors.

Bell & Company are experts in dealing with commercial rent and set-type leases, with over a decade’s experience negotiating with creditors on behalf of businesses. If your business is struggling with cash flow or a commercial lease, contact our team today at 0333 305 4331 to explore your options.