In most cases, directors are not liable for the debts of a limited company. However, there are some circumstances in which directors could be liable and forced to pay these large debts, putting their personal assets at risk.

If You Have Signed a Personal Guarantee…

Often directors are required to sign a personal guarantee for business loans. If you fail to make payments or default on the loan, this will be used to recover the debt.

If you fail to repay the loan or your company enters insolvency, any previous repayment agreements become void. This means that you are liable for the full value of the loan, not monthly repayments.

Everyone who signed is liable and creditors can request repayment at any time. This means that if you and another person signed the personal guarantee, you are both jointly responsible. If the other party does not pay, your creditor could end up being forced to repay the full value.

Unless you have the cash to pay, the creditor can issue a statutory demand and make you bankrupt, putting personal assets at risk.

If You Received a CBILS or BBLS Loan

The Government recently introduced new laws as a result of the misuse of these schemes. This bill opens the door for investigations into current and past company directors

The Insolvency Service could use this to remove any protection offered by a limited company, leaving current and former directors liable for the company’s debts. This is especially likely if the company was a recipient of a CBILs/BBLs loan.

If You Have Borrowed Money From Your Company

A director’s loan account (DLA) is a record of transactions between directors and the business. If a director takes more money out of the company than they put back in, the loan account becomes ‘overdrawn’.

Companies often write off director’s loan accounts in end-of-year accounts. However, they do not go away, as a loan they are subject to interest and tax. This means that the amount you owe will continue to increase.

If the company enters insolvency the director’s loan account is treated as an asset of the company. As such, you may have to pay the full value back. If you are unable to repay the loan, you may have to follow a formal insolvency route such as bankruptcy.

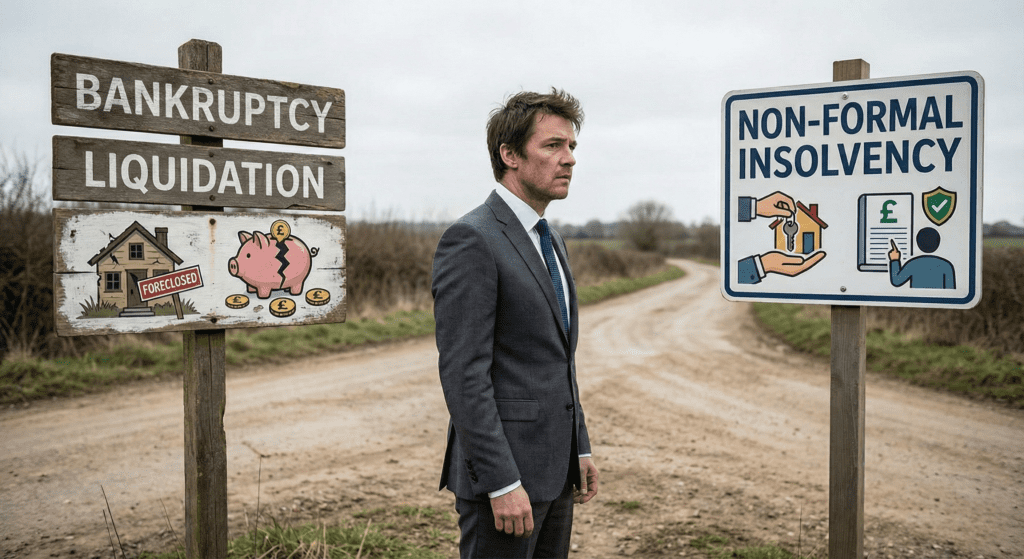

If You Have ‘Traded Wrongfully’

When your business enters insolvency, your responsibility shifts from the needs of shareholders to those of creditors. If you continue to trade while insolvent, you could be liable for all of your business’ debt, regardless of personal guarantees. Again, if you cannot pay these debts, you could be opening yourself up to formal insolvency proceedings.

What to do Next

Most importantly, there are always options therefore you don’t have to face the stress and uncertainty of being liable for repayments by yourself.

In addition to the above, Bell & Company, as pre-insolvency consultants, specialise in helping people like you. Contact us today to find out your options.