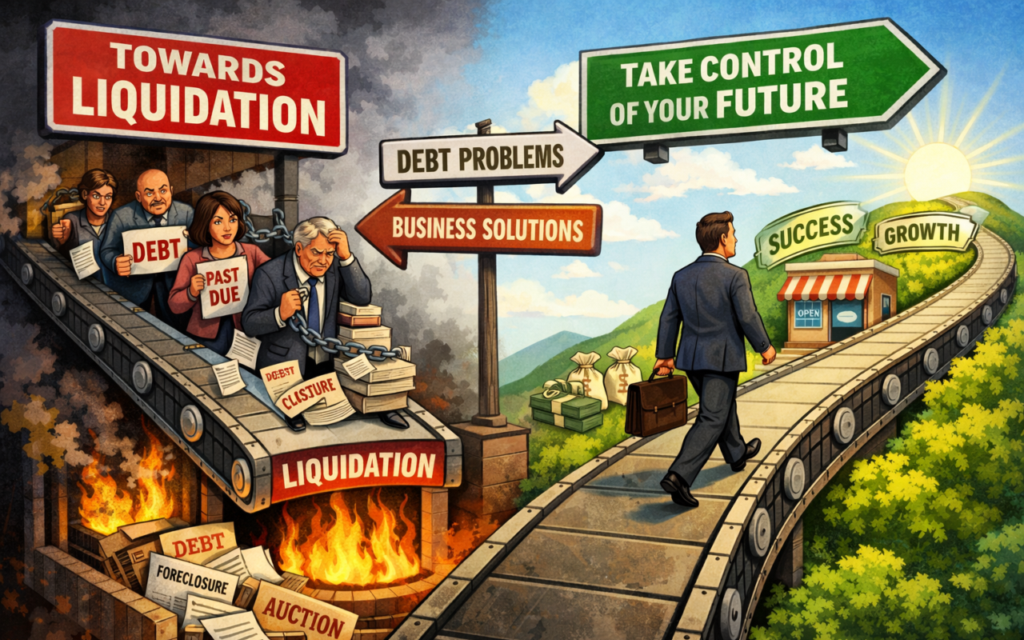

Why Choose Bell & Company? 7 Differentiators for Stressed Business Owners

When business owners approach Bell & Company, they are often at their breaking point – exhausted, stressed, and wary of the “advice” they’ve received elsewhere. Many have already consulted with insolvency practitioners or accountants who left them feeling like just another number. A comprehensive analysis examining competitor-related discussions across our consultation calls revealed a…

Read Full Story