When a 70-year-old former director contacted us, he was facing significant personal and financial pressure.

Following the liquidation of his construction company, several lenders began pursuing him under personal guarantees he had signed during trading. The combined exposure was substantial, and creditors had begun escalating recovery action.

At the same time, he had recently been diagnosed with cancer.

With his health deteriorating, he needed a structured resolution, not prolonged litigation.

The Client’s Priorities

During our initial consultation, his objectives were clear:

- Protect the jointly owned family home

- Prevent his wife from being drawn into legal proceedings

- Resolve matters quickly so he could focus on treatment and family

This was not simply a debt negotiation. It required careful legal positioning and risk management.

The Challenge: Appearance vs. Reality

One of the most pressing liabilities was an £105,000 personal guarantee with a leading fintech lending platform. Litigation had been threatened, and collection activity was escalating rapidly.

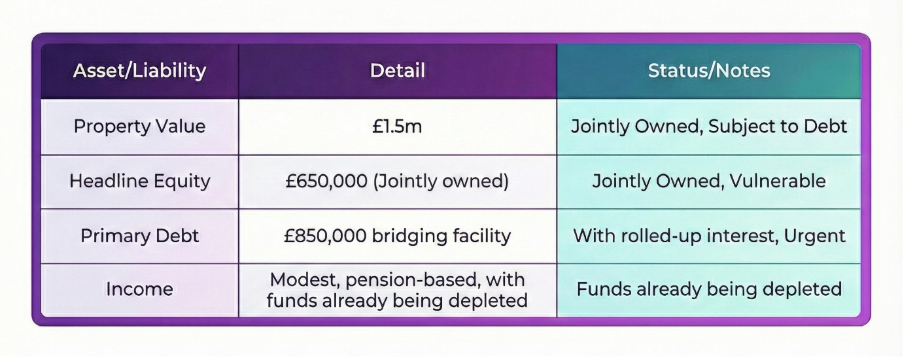

On paper, the client appeared to be a prime candidate for full recovery. However, Bell & Company undertook a deep dive into the details, revealing a far more complex financial picture:

The Risk Without Early Intervention:

Had he attempted to manage matters alone, the creditor had clear legal escalation routes available.

These could have included:

- Seeking a Charging Order over his beneficial interest in the jointly owned property

- Ultimately, pursuing bankruptcy proceedings

In a forced enforcement scenario, the apparent “headline equity” in the property may not have translated into meaningful recovery. Enforcement costs, statutory interest (often 8% per annum), trustee fees (in bankruptcy), and legal expenses can significantly erode available equity.

In addition, bankruptcy would have placed control of his assets in the hands of a trustee, removing the ability to manage timing, negotiation, or sale strategy.

For a retired director with serious health concerns, that loss of control – both financial and personal – carried material consequences.

Sector Insight: The Construction Landscape (2025-26)

This case is reflective of a wider trend across the UK. The construction industry has remained the most volatile sector in the UK economy throughout 2025 and into early 2026.

- Specialist Risk: Specialist construction activities (like our client’s firm) are particularly vulnerable, accounting for over 53% of all sector insolvencies due to fixed-price contract pressures and rising labour costs.

Our Strategic Approach

At any given time, our team manages approximately 350 live cases involving personal guarantees and complex creditor negotiations. We understand that creditors often act on “surface-level” data; our job is to provide the full commercial context.

To resolve this case, we:

- Revalued the Equity: We conducted a realistic assessment of the realisable asset value in a forced-sale scenario, rather than relying on optimistic market valuations.

- Analysed Sustainability: We demonstrated that the client’s pension-led income could not sustain long-term repayment plans.

- Humanised the Case: We gathered updated medical evidence to provide the necessary context regarding the client’s urgency and vulnerability.

- Structured a “Full & Final”: We presented a third-party-funded proposal, arguing that an immediate, guaranteed lump sum was preferable to the risk and delay of bankruptcy proceedings.

Rory McGimpsey, Head of Corporate Debt Solutions at Bell & Company, who led the negotiations, highlighted the critical turning point:

“The biggest challenge here was the profound disconnect between the ‘headline’ equity creditors saw on paper and the commercial reality of a forced sale. We had to bridge that information gap quickly while navigating a very sensitive personal situation for the client.

“By presenting the complete financial picture – including the heavy burden of the bridging finance and the client’s health crisis – we were able to move the conversation away from automated collections teams and in front of commercial decision-makers who understood the risks of pursuing bankruptcy.”

The Outcome: A 76% Reduction

By escalating the matter to the creditor’s internal Business Support Division, we moved the conversation away from automated collection and into the realm of commercial pragmatism.

The Results at a Glance

- Original Liability: £105,000

- Settlement Accepted: £25,000

The Human Impact

Beyond the financial savings, the strategic resolution achieved every one of the client’s primary goals:

- Bankruptcy avoided and the family home secured.

- No enforcement action commenced against the wife.

- Pension assets preserved for future living costs.

- Immediate peace of mind during a critical health crisis.

Why Professional Representation Matters

In Personal Guarantee cases, creditors often mistake “asset-rich” for “cash-rich.” Without a structured financial presentation, headline property equity often triggers aggressive legal action.

By reframing the commercial reality and presenting credible, documented evidence, we shifted the creditor’s perspective from enforcement to settlement.

Professional Standards

Bell & Company operates to the highest professional standards. Our team includes members of R3 (The Association of Business Recovery Professionals) and we adhere to FCA-regulated activity guidelines where applicable. While every case is unique and outcomes cannot be guaranteed, early intervention is almost always the deciding factor in a successful resolution.

Are you facing pressure from Personal Guarantees?

If your company has entered liquidation or you are concerned about protecting your family home, we can help.

Book a Confidential Consultation