When one director first received our advice, his reaction was a mix of relief and anger: “I can’t believe I’ve not had someone tell me that before.”

For months, he had been under intense pressure from external advisers. He was presented with formal insolvency as the only legitimate way forward, left with the impression that once the company was liquidated, the problems, including the debts, would simply end there. The personal consequences were never clearly outlined. Like many directors, he was exhausted, confused and, quite frankly, worried about the future of his finances.

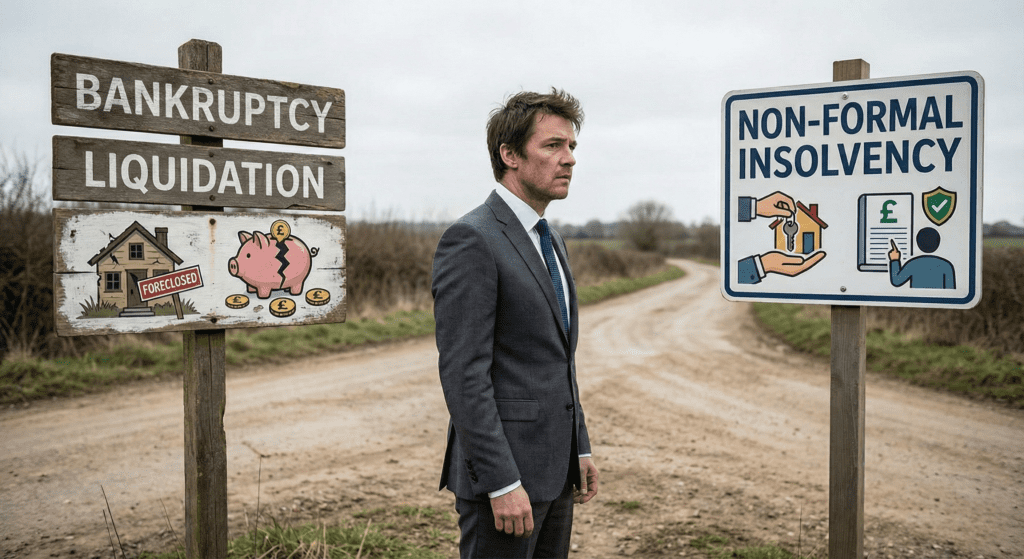

However, the so-called “standard” route is not always the right one. Increasingly, directors are questioning the traditional insolvency model and exploring alternative, non-formal insolvency options that may better protect both their businesses and themselves.

The Problem with the “Professional Advice” Monopoly

When a company faces a financial crisis, the instinct is to call an Insolvency Practitioner (IP). While IPs are regulated professionals, their business model often relies on one outcome: Formal Process.

1. The “Fear Factor”

When facing financial distress, many directors describe feeling overwhelmed and under significant pressure to act quickly. In that environment, formal liquidation can sometimes be presented as the safest or most responsible option, particularly where potential personal exposure is mentioned without full context.

One client reflected on how their experience felt reassuring at first but later became more transactional once the process was underway. That shift in tone left them feeling unsettled and unsure about whether they had fully understood all of their options from the outset.

Concerns about penalties or personal consequences can understandably heighten anxiety. While the range of potential sanctions, from financial penalties to, in very serious cases, criminal charges, is set out in legislation, official Insolvency Service data shows that criminal prosecutions are rare. Even so, the perceived risk can significantly influence decision-making, sometimes leading directors to proceed with formal processes without fully exploring alternative routes.

2. The Barrier of Upfront Costs

A formal liquidation can represent a significant financial commitment at an already difficult time. Beyond the commonly referenced £10,000 + VAT starting point, additional costs can arise during the process, including fees linked to asset realisations and other professional expenses, which may not always be fully anticipated at the outset.

For businesses already facing cash flow pressure, this level of upfront funding can feel overwhelming. As one director put it: “It’s a high barrier to entry…to basically pay £12K just to get it started.”

The industry often markets Pre-pack Administrations or Company Voluntary Arrangements (CVAs) as “fresh starts”. The reality is often different.

- The Pre-Pack Regret: One client who opted for a pre-pack noted: “I should have just let it go. It was pride. I’ve had years of horror since.”

- The Advisor Fatigue: Even accountants sometimes reach their limit, with one telling a client to “just let them make you bankrupt,” offering no strategy for asset protection or mental well-being.

The Alternative: A Commercial, Strategy-First Approach

Non-formal solutions focus on commercial negotiation and statutory procedures outside of a liquidator’s control. This approach prioritises the director’s future, not the practitioner’s fee.

Rather than immediately proceeding to formal insolvency, a structured strategy may involve:

- Informal Creditor Negotiations

Engaging directly with creditors to explore settlement or repayment arrangements, where viable, without entering a formal insolvency process.

- Strategic Dissolution

Where a company has ceased trading and has no remaining assets, using the Companies Act dissolution procedure correctly and transparently as a cost-effective way to close the business.

- Asset and Position Planning

Taking appropriate legal advice to understand personal exposure.

The key is ensuring directors understand all lawful options available to them, so decisions are informed, balanced, and appropriate to their specific circumstances.

As one director noted, “To have a strategy takes the pressure off. It’s good to know someone is on my side, shielding me so I can actually run my business.”

Before committing to a high-cost liquidation, ask yourself:

- Am I being pressured? High-pressure tactics usually serve the advisor, not the business.

- What is the “Total Cost”? Beyond the initial fee, consider the impact on your credit, your reputation, and your ability to be a director in the future.

Draw a line in the sand today.

You shouldn’t have to wake up anxious every time the phone rings.

We work with directors to manage creditor pressure constructively and to develop a clear, lawful exit strategy tailored to their circumstances – without unnecessary alarm or disproportionate upfront costs.

If you’d like clarity on your options and a steady plan forward, we’re here to help.

Schedule a confidential consultation and take the first step toward peace of mind.