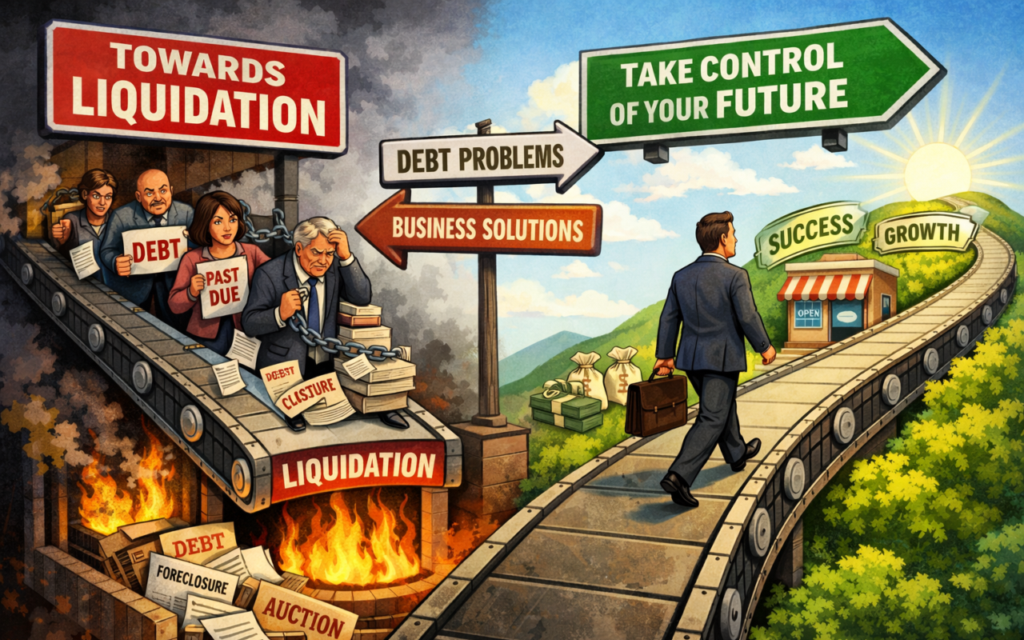

Halloween is the perfect time for spooky metaphors, but let’s be honest: the scariest thing in business isn’t the debt itself – it’s doing nothing about it.

For directors facing mounting pressure, waiting until the new year is not a plan; it’s a debt death wish. Every day of inaction increases the risk of being blindsided by enforcement action, called-in personal guarantees (PGs), or crippling HMRC pressure.

Debt doesn’t have to be fatal. When you act early and bring in the right strategists and negotiators, you can turn a financial horror story into a recovery story.

The Real Horror: Why Waiting to Get Help With Debt Is a Debt Death Wish

The biggest mistake we see directors make is confusing hope with a strategy. They believe they can manage their way out, but in reality, debt problems compound quickly. By the time they seek help with debt, they are often facing the immediate, severe consequences we work every week to prevent:

- Enforcement Action & Liquidation: Facing Winding Up Petitions or County Court Judgments (CCJs), which can shut down your company quickly.

- Called-in Personal Guarantees (PGs): Creditors moving to secure payment against your personal assets, including your family home, pensions, and savings.

- HMRC Penalties: Late filing and payment penalties, which are difficult to reverse and quickly erode cash flow.

- Overdrawn Directors’ Loan Accounts: Converting a business problem into a massive personal tax liability.

We specialise in stepping in before these threats materialise, giving you the crucial time, expertise, and strategic protection you need.

Expert Help With Debt: Our 5 Pillars of Business Rescue Strategy

At Bell & Company, we don’t deal in tricks or treats; we deal in no-BS reality checks and tailored strategies that get your business back in control. Our expert negotiators are dedicated to achieving a commercial resolution for you through our core specialisms:

- HMRC Time To Pay (TTP) Arrangements: We construct and negotiate realistic payment terms with HMRC, built on solid financial forecasts that prove viability, often preventing immediate enforcement and keeping viable companies trading.

- Protecting Personal Guarantees (PGs): This is one of our most vital services. We specialise in safeguarding directors’ personal assets, challenging unfair claims, and negotiating substantial debt settlements to shield your home and savings.

- Business Restructuring and Creditor Negotiation: We design bespoke, forward-looking plans to reduce debt, preserve reputation, and restructure liabilities, setting the business up for a sustainable future.

- Resolving Directors’ Loan Accounts: We proactively address overdrawn loan accounts, resolving issues before they become personal liabilities or complicate insolvency proceedings.

- Challenging Insolvency and Liquidation Threats: We provide strategic defence and representation against unfair claims and Statutory Demands, steering businesses toward better outcomes than default liquidation.

Authority in Action: Real-World Case Studies & Results

Our approach is validated by hard numbers. We deliver measurable, life-changing results for directors across various pressurised sectors. This quarter alone, we’ve achieved over £1.2 Million in client savings, but our work goes far deeper than a single number – it’s about protecting livelihoods and homes.

Protecting Directors from Personal Guarantees (PGs)

Many of our clients come to us facing severe threats from Personal Guarantees, where business failure puts personal assets at risk. We recently helped a director in the Retail sector who was hit with a crippling £183,000 PG demand from an aggressive FinTech lender after their business entered administration. Through expert negotiation and strategy, we slashed the debt down to a final, manageable settlement of £63,000, securing a massive £120,000 saving and protecting the director’s future. Similarly, in another high-stakes negotiation, we helped a client facing a daunting £300,000 debt secure a 90% debt write-off with a £30,000 settlement, allowing the family to keep their home.

Strategic Settlements and High-Debt Reductions

Our expertise extends to complex, multi-faceted debt situations. A director in the Construction sector, facing £600,000 in total debt and the threat of personal bankruptcy, needed a strategic defence after their property firm failed. We secured an incredible 85% debt reduction, resulting in a £90,000 settlement and ending the imminent threat to their family home. We apply this same rigour to specific industry challenges, such as when we assisted a Gym & Fitness Director with a £330,000 liability. Our intervention resulted in a 50% debt reduction, cutting the debt in half and safeguarding the director from personal financial ruin. These results demonstrate our commitment to achieving commercial resolutions, no matter the severity of the debt.

Read more of our case studies here: https://bellcomp.co.uk/what-our-customers-say/case-studies/

Client Validation

We saved the business, but more importantly, we saved the director’s sanity and future. But don’t just take our word for it, our clients say it best:

A brilliant experience!

My experience with Bell & Co and in particular Micaela Cruz was simply brilliant, smooth, worry free and patient.From the outset everything was explained to me clearly and this communication continued throughout the journey. Micaela always remained calm, patient, informative…

Thomas Hughes – GB

See Full Testimonial

Exceptional & Professional Company.

I reached out to Bell & Co as i was being chased by Barclays Bank over a personal guarantee that I had signed for a Ltd company I was part of 20 years ago. Despite several assurances that I was…

Merfyn Evans – GB

See Full Testimonial

Very sticky situation

We were in a bad situation with our company and once we talked to Luke at Bell & Co he put us at ease. He assured us that they could negotiate with the banks to come to an agreement on…

Mike Pimlott – GB

See Full Testimonial

Bell & Co did an amazing job !

Initially is was not sure about using this company as I had never heard of such a solution. The team took the time to explain how they can help and so I signed up. Immediately Luke Logan jumped into action…

Ian – GB

See Full Testimonial

Excellent & Professional Help

The response and empathy received from this company was excellent. Given a difficult and scary situation they offered sound advice and suggested a route to move forward. What appeared hopeless has turned into an opportunity for resolution. We heartily recommend…

Jeremy Willan – GB

See Full Testimonial

I had a issue with one of my rental…

I had a issue with one of my rental properties and it was not sustainable to continue so I handed back to the bank. I spoke to Bell& Co and they agreed to take on my case. Luke was extremely…

Simon – GB

See Full Testimonial

Take Control: Don’t Let Debt Paralyse Your Business

If your finances are starting to feel spooky, remember: debt doesn’t have to be scary – ignoring it is.

We are the experienced strategists and expert negotiators you need to confront the fear, calm the chaos, and take back control. When it comes to creditor negotiation, we’re spookily good at it. 👻

- Stop Using Personal Funds: Do not use your personal savings to plug business gaps; it is rarely recoverable and increases your personal exposure.

- Book a Confidential Strategy Call: The earliest conversation is always the most effective. Your options diminish the longer you wait.

Ready to start? Reach out today for a confidential, no-obligation assessment. Let’s work together to achieve a commercial resolution for you!